Markets

kept up very well last week and stocks are still not in the mood for

any pullback. That will obviously change some day, but when? I don't

know how many under water shorts are still waiting for a decent chance

to get out, but that could be one of the reasons why this market has

refused to pull back since its new record highs.

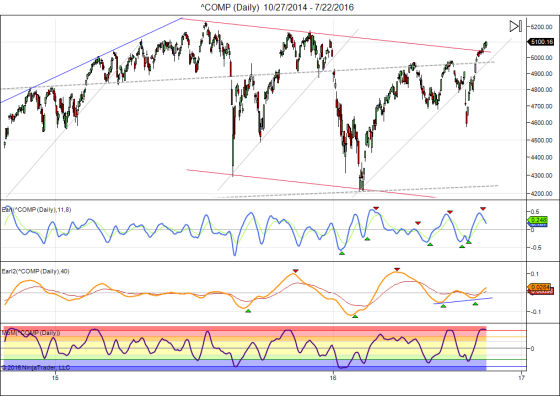

Here is the current Nasdaq chart:

Here is the current Nasdaq chart:

While

the S&P 500 is at new highs the Nasdaq still has quite a few

hurdles in front of it before it can do the same. The 5100-5200 area is

heavy overhead resistance in this index.

The Earl index (blue line) has started pulling back from a major high, but the market is not coming along. Meanwhile a new lunar green period is starting, which normally favors further gains. But the lunar cycle hasn't worked well so far this year, so we better be careful. The slower Earl2 (orange line) is still headed higher, suggesting further gains in the pipeline.

I see a very mixed technical picture, so I am not going to commit too strongly either way at this point. The short term momentum is clearly up, but that can change very quickly. We will probably get more clarity soon.

The Earl index (blue line) has started pulling back from a major high, but the market is not coming along. Meanwhile a new lunar green period is starting, which normally favors further gains. But the lunar cycle hasn't worked well so far this year, so we better be careful. The slower Earl2 (orange line) is still headed higher, suggesting further gains in the pipeline.

I see a very mixed technical picture, so I am not going to commit too strongly either way at this point. The short term momentum is clearly up, but that can change very quickly. We will probably get more clarity soon.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.