This post is about an article found on MarketWatch.com

The link to this article can be found at the bottom of this post.

"Historical pattern says the risk of a 2016 bear market is zero"

By Simon Maierhofer

Published: Feb 25,2016 12:57p.m. ET

In physics, escape velocity is the minimum speed needed for

an object to break free from the gravitational attraction of a massive

body. What is the “escape velocity” needed for stocks to break their

down trend?

Unlike in physics, there is no fail-proof

formula for stocks. However, based on history, the S&P 500 just

rallied strongly enough to end its down trend. How so?

Stock-market 'escape velocity'

On

Feb. 12, 16 and 17, the S&P 500 gained more than 1.5% a day for

three consecutive days. Since 1970, this has happened only eight other

times. The table below lists each occurrence along with the daily

consecutive gains, and the return a year after the last “kickoff” day.

The charts at the bottom of the column provide a snapshot of each

kickoff rally (dashed green line) and how the S&P 500 did 60 trading

days (about three months) prior, and 255 trading days (above one year)

thereafter.

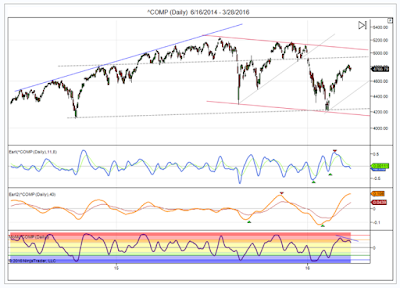

JustSignals Comment - The above mentioned charts can be seen in the full article (see link below). The charts below show a longer period leading up to the 3-4 day "kickoff" or thrust days which is circled in black. Also included in the charts are moving averages, kickoff days and the percentage gains one year later as noted in the chart above.

Observations by author

- Every single time the S&P 500 gained more than 1.5% a day for three consecutive days, it traded higher a year later.

- The S&P 500 violated the low set prior to the kickoff move only twice (1987, 2002). Both times it bounced back quickly.

- In

2016, the S&P 500 closed at a 52-week low before its kickoff rally.

In 1970, 1987 and 2011, the S&P 500 also closed at a 52-week just

before soaring higher.

- Obviously, kickoff rallies like this are

not the only factor driving stocks, but this particular pattern

confirms the six reasons for a stock market rally listed by the February

11 Profit Radar Report (all six reasons are available here).

- The

Feb. 11 Profit Radar Report recommended buying the S&P 500 at 1,828

(after it fell as low as 1,810) in anticipation of a sizeable rally.

- As

compelling as this historic pattern may be, tunnel vision is a luxury

investors can't afford. It's worth noting that the 2016 kickoff is

weaker (in terms of consecutive percentage gains) than prior kickoff

rallies, and our major-market-top liquidity indicator raised a caution flag in May 2015.

- The scope of this rally has yet to be revealed, and a break below the February low is still possible (like in 1987 and 2002).

- Regardless

of the S&P's near-term path, history says we shouldn't under

estimate this kickoff rally. Acting on the sentiment-based buy signal at

S&P 1,828 provided a low-risk entry point and insurance against a

runaway rally.

Link to full article

http://www.marketwatch.com/story/historic-pattern-says-the-risk-of-a-2016-bear-market-is-zero-2016-02-25

JustSignals Comments:

Average Election Year :

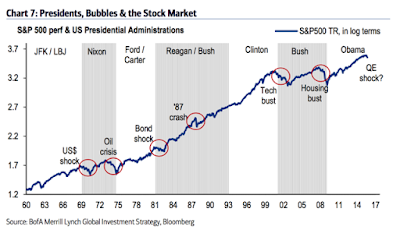

Two of the years in the charts above are Election Years 1984 & 2016.

Also again note that, the S&P 500 violated the low set prior to the kickoff move only twice in 1987& 2002. So it can happen again with the Average Election Year chart suggesting another low in the June +/- time frame. Is this guaranteed? Of course not ! But look at and study all the charts including the Average Election Year chart and come to your own conclusions.

The

Intermediate Term Cycles have been looking for a market correction in the

first half of 2016 and they suggest a bias up in the second half of 2016. The Intermediate Term Cycles do look very ominous for several years after 2016.

There is other information also suggesting these moves in 2016.

1) The pattern of the Average Election Years, see chart above.

2) The 7th year of a two term President. 2015 was the first time since

1939 that the DJIA was down in the 7th year of a Presidency. The DJIA

fell about 1/3 in 1940-1941. Note that 1940 was also an election year and it did follow a similar pattern to the one in the chart above with a mid year low.

3) The final year of a two term Presidency. In 5 of the last 6 times, the DJIA dropped and average of 13.9%. So far in 2016 the DJIA fell about 10% from 12/31/15 to the closing low in Feb2016.

4) No Santa rally this year. Yale Hirsch said, " If Santa Claus should fail to call, bears may come to Broad and Wall". Was the January & February lows the low for the year or will there be another low?

5) The weekly chart shows two bullish candle sticks. One for the week of 1/18/16 & another for the week of 2/8/16.

6) The monthly chart shows one bullish candle stick for the month of February 2016.

The market does not go straight up

or straight down. In all the charts above there were several changes in

trend. Be nimble and be careful. The markets always tries to shake out

as many investors and traders as possible. This is nothing new.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This

has been posted for Educational Purposes Only. Do your own work and

consult with Professionals before making any investment decisions.

Past performance is not indicative of future results