|

| Courtesy By Danny of LunaticTrader |

By Danny

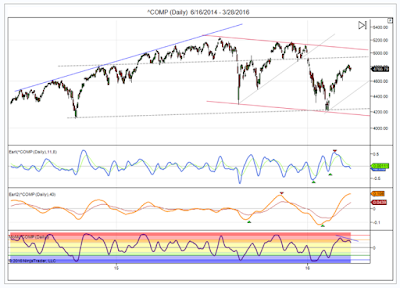

This

index topped out at 4835 early in the week, right in the area where

stronger overhead resistance is likely. The Earl indicator (blue line)

is already back in the bottom zone, which means another push higher is

not out of the question at this point. But the slower Earl2 (orange

line) is making a major high and about to turn lower, and that is

usually a headwind for any rally attempts. The MoM indicator is painting

a bearish divergence, and that may keep a lid on the market as well.All in all this is not a very favorable setup for trades on the long

side. The more likely scenario is consolidation, probably sideways with

dips as low as 4600 for Nasdaq.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.