The end of a two-term president is usually bad news for the stock market

By Myles Udland at BusinessInsider.com

November 2, 2015

Barack Obama has 15 more months left in the White House. (Written Nov. 2,2015)

And as his eight years in office come to a close, investors looking at the end of recent two-term presidencies might have reason to be nervous.

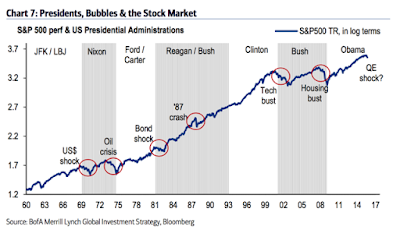

In a note to clients on Sunday, Michael Hartnett and his team at Bank of America Merrill Lynch looked at the relationship between presidential terms, the stock market, and asset bubbles that have cropped up during those years.

And so while the Obama presidency has seen enormous stock market and job market gains as the economy has recovered — however slowly — from the financial crisis, there might be reason to get nervous about what the next few years hold.

As Hartnett and his team note, four notable financial mispricings have led to significant market events at the end of recent two-term presidencies: the overvaluation of the US dollar after JFK/LBJ, the undervaluation of bonds after Ford/Carter, the overvaluation of tech after Clinton, and the overvaluation of housing after Bush.

2015 has already proven a challenging year for investors, a claim that no one is likely to deny even if the last two months of the year see stock markets continue their big October rally.

As Hartnett writes, "2016 should be another tough year for markets, another year of 'deflationary expansion,' and a perilous transition to the promised normalization of Higher Growth & Higher Rates."

Here's the unsettling chart:

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.