Market Letter

Hello!

The Dow, the

S&P 500, and the NASDAQs had been trading generally sideways for at least

two weeks in an overbought condition attended by extremely high bullish investor

sentiment. Then, as a child tests

his parent for days on end, the bulls continued to challenge and prod, leading

to several days of gap-up Opens which settled back into sideways moves for the

rest of the day. The situation was

akin to that of an inflating balloon, in which the observer knows what the

eventual outcome will be – the only question being When it will happen. It’s too soon to be certain; but it may

be that the balloon popped today.

In recent

weeks and moonths, the Russell 2000 and the S&P 600 SmallCaps had been

lagging the Dow, theS&P 500, and the NASDAQs; but recently they had caught

fire and had set new Highs of their own, which signaled a return to the Bull

party of the “man-in-the-street” investor.This phenomenon typically occurs at

the very end of a bull trend, and is characteristic thereof. It is a powerful warning that the party

is ending. It is also a signal that

the “little guy” is about to be burned, unless he is very careful and fleet of

action.

On the

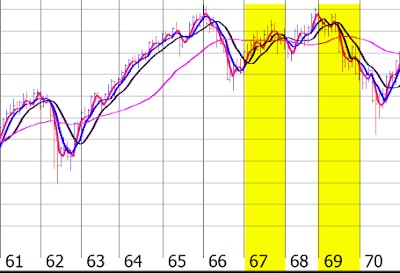

60-minute chart of the NASDAQ Composite, please note the worry at the top, where

a series of small downmoves (together) bearishly engulfed the single spike-bar

to the top; and, especially, the Gap on the downswing which followed – and the

relatively strong Down Close.

Please also

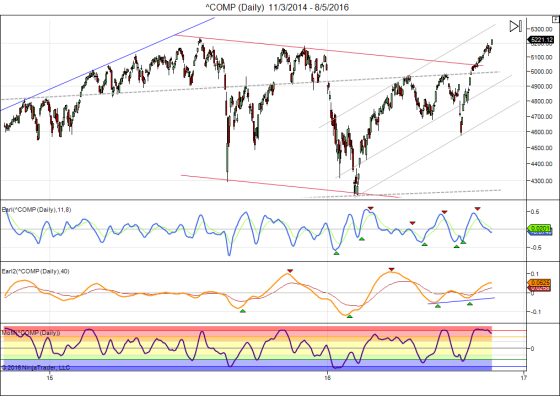

note the clearly bearish cast of the topping-and-reversing pattern shown on the

S&P 600 SmallCaps chart.

All of the

factors cited above are bits of evidence – not proof – that the tide may have

turned, to the downside. I think

that the odds favor a decline; and it could be substantial. My suggestion is toseriously consider

taking some of your chips off the

table.

Silver seems to be especially vulnerable to

a decline. We can see what appear

to be Exhauston Gaps on the way Up, and a large Rounded Top. The most powerful argument lies in the

Commitments of Traders chart, which shows that the Large Speulators (“hedge

funds”) are in a higher Net Long position than EVER. This situation cannot continue forever,

or for much longer. It is a recipe

for a massive implosion. The Silver

bulls have been testing, testing, testing the limit. The “little guy” is right in there too,

Net Long; and when the dike finally breaks there will be a mass rush for the

exits that will be a sight to beold; and not everyone will be able to escape

unscathed. I think that the “little

guy”should call it a day, pack it in, and get out now.

Respectfully submitted.

CandleWave, LLC

By William Kurtz,

President

906 Whippoorwill Dr., Palm Harbor FL 34683

USA

Wkurtz1@verizon.net

info@CandleWave.com

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This

has been posted for Educational Purposes Only. Do your own work and

consult with Professionals before making any investment decisions.

Past performance is not indicative of future results