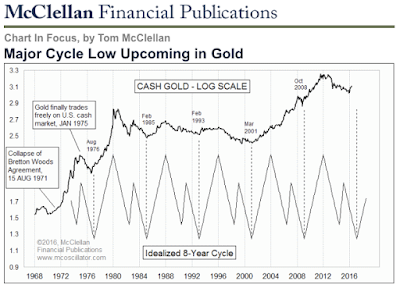

There is a major cycle low looming for gold prices. Ideally it should

arrive as a price low in late 2016. But based on history, it could

arrive anytime between August 2016 and March 2017, and still fit within

the normal tolerance.

Defining a normal tolerance for gold’s 8-year cycle is a pretty iffy

proposition. We have only 5 prior examples to go by, and while they

cover a period of over 40 years, anyone who ever studied statistics

knows that n<30 is problematic. If you want to wait until n=30

before believing in this cycle, then you only have to wait until the

year 2215.

If you are willing to accept the message from fewer iterations, then

this week’s chart has some interesting insights to offer. A few years

ago I constructed this idealized 8-year cycle pattern, and featured it

in our newsletter. The one leg up, 3-waves down pattern has “worked”

ever since gold finally started trading freely in 1975, with one major

exception. From 2001 to 2009, the normal “left translation” flipped to a

more bullish right translation mode. Aside from that one strong

uptrending period, gold’s price pattern has matched this artificial

pattern pretty well.

The relevance of that insight for the current period is that the next

major 8-year cycle bottom is due this autumn. Ideally it should be due

in February 2017, but another tool suggests that late 2016 is more

likely to see the arrival of that bottom.

There is a dominant 13-1/2 month cycle in gold prices. The next major

cycle low is ideally due in October 2016, but gold regularly makes

bottoms plus or minus a month from the ideal cycle bottoms. So this is

not a tool that will allow anyone to reasonably pencil in a hard date

for when the cycle low is due.

Still, an autumn 2016 bottom for the 13-1/2 month cycle fits well with

the idea of a major 8-year cycle low due in late 2016 to early 2017.

One additional insight from the 13-1/2 month cycle is that we have

already seen “right translation” of the price pattern versus this cycle,

and that one piece of information conveys bullish portents for the

likelihood of a higher price high for gold in 2017, once we get past the

upcoming big cycle low.

Bottom Line:

We have two major long-term cycles, both calling for an important

bottom in gold prices in late 2016. That’s a big deal. The two are

independent of each other, and their confluence in calling for a bottom

later this year has strong implications. Gold prices ought to be

expected to drop downward into that cycle low, but more importantly we

should expect a big uptrend to commence out of that major cycle bottom.

It will be hard for gold bugs to be patient and wait for that major

cycle low to arrive, but the long term cycles say that the ensuing rally

should be worth the wait.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.