Buy when others are fearful

by Danny / LunaticTrader

Markets

fell on the brexit referendum result and fear seems to be all over the

place in what looks like a kind of Stockholm syndrome. But what most

commentary failed to mention is that the FTSE 100 was actually up 1.9%

for the week. EU stock markets took the biggest beating, so it looks

like the market is saying that leaving the EU is better than staying in.

Let's have a look at the Nasdaq chart:

The

Nasdaq is back to its May lows. It could easily fall a bit further and

test the 4600 level. But we have started a new lunar green period and

the Earl and MoM indicators have turned up already. So I would look for

volatility to subside as overblown fears calm down. Panic selling will

dry up and then stocks will start trading with a positive bias.

As

I said during the Greek crisis, stand ready to buy any country that

finds a way to leave the EU or the Euro. Britain is now very likely to

be the first country to take that step, so I would use this to buy FTSE

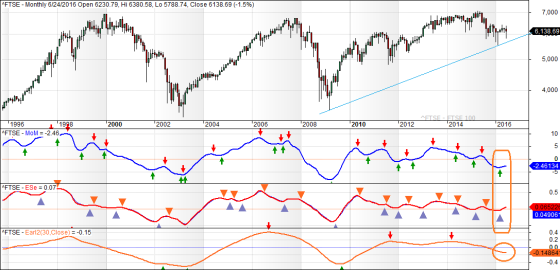

on any weakness. The long term monthly chart for the UK stock market

happens to be very interesting:

The

FTSE stays well above its February lows and that's quite remarkable

given the hysterical comments that are being made. The smart money must

be buying.

Two of my three main indicators have turned up a few months ago and the slower Earl 2 is ready to follow suit. That is a favorable long term setup. A breakout above the multi-decade resistance around 7000 is possible in the medium term, and that would open the door for a further rally. Buy when others are fearful.

Two of my three main indicators have turned up a few months ago and the slower Earl 2 is ready to follow suit. That is a favorable long term setup. A breakout above the multi-decade resistance around 7000 is possible in the medium term, and that would open the door for a further rally. Buy when others are fearful.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

Just submit your email address in the box on the Blog homepage

This has been posted for Educational Purposes Only. Do your own work and consult with Professionals before making any investment decisions.

Past performance is not indicative of future results

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.