Chart In Focus, by Tom McClellan

The Market, Under a New President

November 10, 2016

Investors get fearful ahead of a big election, because the outcome is

unknown. Unknown risks are what investors fear most. Now that the

result is decided, we have known risks to deal with.

Investors were also fearful ahead of the 2012 election, which also had a

surprising (for some) result. Recall that Gov. Romney had been up by

1-4% in the last polls leading up to that election. Polling that year

was admittedly disrupted by the arrival of Hurricane Sandy, which also

shut down the stock market for 2 days.

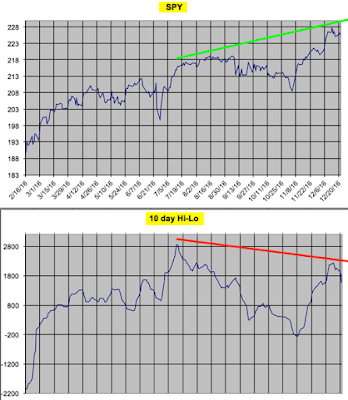

And interestingly, the market now is doing a pretty good imitation of

the path of price movements 4 years ago. In 2012 there was a dip into

mid-November after the Nov. 6 election. This time it was a dip the week

before the Nov. 8 election. But in each case there has also been a

strong rebound after that dip.

You may have heard before that having a Democrat president is better

for the stock market than having a Republican president, and there are

statistics which can be used to support that. In the following chart,

the averages for each category since 1933 are plotted:

The real truth is a lot more nuanced than just saying one is better

than the other. On average, the market has performed better for the

first 16 months of Democrats’ terms, but then by the 3rd year that advantage completely disappears. And market performance in the 4th

year is worse on average under a Republican president. A big part of

that is the weakness after the Oct. 1987 crash, and from the 2008 bear

market, both of which happened under Republican presidents.

Another differentiation among presidents concerns whether there is a new president from a different party, versus a 2nd

term president or a new one from the same party. This one is a much

bigger deal, especially during the first year of a new presidential

term.

Generally speaking, investors respond more favorably at first to

getting a new president from a different party. This has to do with

celebrating that they got the change they wanted (or so they think).

That positive emotion tends to wear off right around inauguration day,

when they realize that the new president has not fixed all of the

problems already.

The negativity under a new president persists as the year runs on,

because of a habit they all seem to have. I have seen this same

behavior repeatedly over my lifetime. A new president comes in, and

spends his first year “discovering” that conditions are even worse than

we were told during the campaign, and then tells us that “the only

solution” is whatever package of tax hikes/cuts or spending adjustments

he wants to make.

Bill Clinton did this in 1993. Despite 5% GDP growth then, Clinton

asserted that “This is the worst recession in 50 years,” and he wanted

to jam through a $20 billion package of pork barrel spending (mostly to

reward campaign contributors). Congress wisely said no. When I think

back on that, I realize that $20 billion is such a cute little number

compared to the size of the “fixes” that have come since then.

With Bush 43 in 2001, it was tax cuts, although he could not get all he

wanted right away and had to do another round in 2003. With Barack

Obama in 2009, it was the American Recovery and Reinvestment Act, with

$831 billion in stimulus spending (see why $20 billion is a cute little

number)? They all seem to do it.

Investors generally don’t like hearing that things are worse than

previously believed, and that creates a depressing effect on stock

prices during a first year. Generally speaking, 2nd term

presidents do not spend very much time blaming the immediate

predecessor, or finding things wrong, and so investors don’t get

frightened away as much. But as noted previously, that difference in

stock market performance between 1st and 2nd term presidents generally goes away by the end of the 2nd year.

Every instance is different, and these charts just show what the average behavior has been.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This

has been posted for Educational Purposes Only. Do your own work and

consult with Professionals before making any investment decisions.

Past performance is not indicative of future results