LunaticTrader.com

By Danny

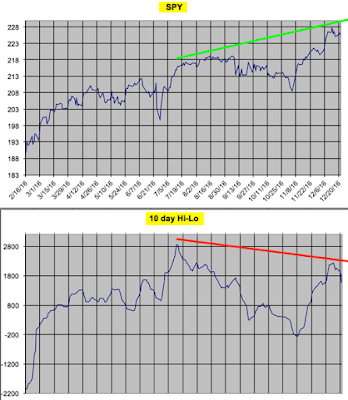

Markets had a fairly flat week and a few attempts to push the Dow above

20k have come up short. The recent lunar red period ended with a 181

point gain for the Nasdaq and we are now starting a new green period.

That would normally get us above 20k, but the green periods have been

weak all year so that isn't helping much. Let's have a look at the

S&P 500:

|

| Courtesy of LunaticTrader.com |

This index is bumping into a few overhead resistance lines. There is

also a bearish divergence appearing in my Earl indicator (blue line),

which is an early warning sign. The slower Earl2 (orange line) keeps

going up, but may be nearing a top as well. The MoM indicator is still

in the +8 very optimistic zone.

All in all the lunar green period and the slower year-end trading could

be enough to push the S&P to 2300 and the Dow above 20k. But that is

not a given and would probably be followed by a slow start in 2017.

A choppy market for the rest of the year would be healthier. Stocks

could catch some breath and that would give us a nice setup going into

January.

I don't know what will happen, but with most of my indicators looking

rather stretched I am going to trade cautiously until those readings

come down to more neutral levels.

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This

has been posted for Educational Purposes Only. Do your own work and

consult with Professionals before making any investment decisions.

Past performance is not indicative of future results